Download your free copy of the latest Financial Technologist magazine here.

Until ClearBank was given its Banking Licence in 2017, there were only four remaining clearing banks in the UK (Barclays, HSBC, Lloyds and Natwest). ClearBank was established to be the fifth, but the first newly licensed in 250 years. But ClearBank set out with a difference: unlike the other clearers, ClearBank has a particular focus on payments. In other words, we don’t lend money and we don’t take deposits from retail customers. From the outset, our ambition was to modernise the infrastructure and excel at payments. Furthermore, we provide the assurance that all of our client funds are held at the Bank of England, and are therefore risk-free.

With its licence granted in 2017, ClearBank was able to become a direct participant in CHAPS, Bacs, Faster Payments and eventually ICS, the digital cheque-clearing system. We connect directly to all of the schemes. ClearBank has remained true to its heritage and offers key banking and payment infrastructure services now to over 200 regulated financial institutions from start-ups to global brands. ClearBank has played an important part in helping the UK foster our thriving FinTech, E-money, and payments industry, as the bank acts as an interface between regulated financial organisations and the Bank of England. We do not compete with our customers, therefore we do not offer a B2B or B2C service.

Our application is designed, developed, deployed, and maintained by ClearBank engineers, all of whom are based in the UK. But of great relevance to our clients is that we are entirely cloud-native. While many of us are now familiar with cloud computing, back in 2015, this was rare in the banking sector. In order to fulfil ClearBank’s ambitions ultimately to offer global payments infrastructure, we needed to work on a cloud-based banking platform which could be easily scaled, and we have partnered with Microsoft Azure to achieve that. We were also cognisant of the regulatory and commercial needs to ensure we can provide ISO20022.

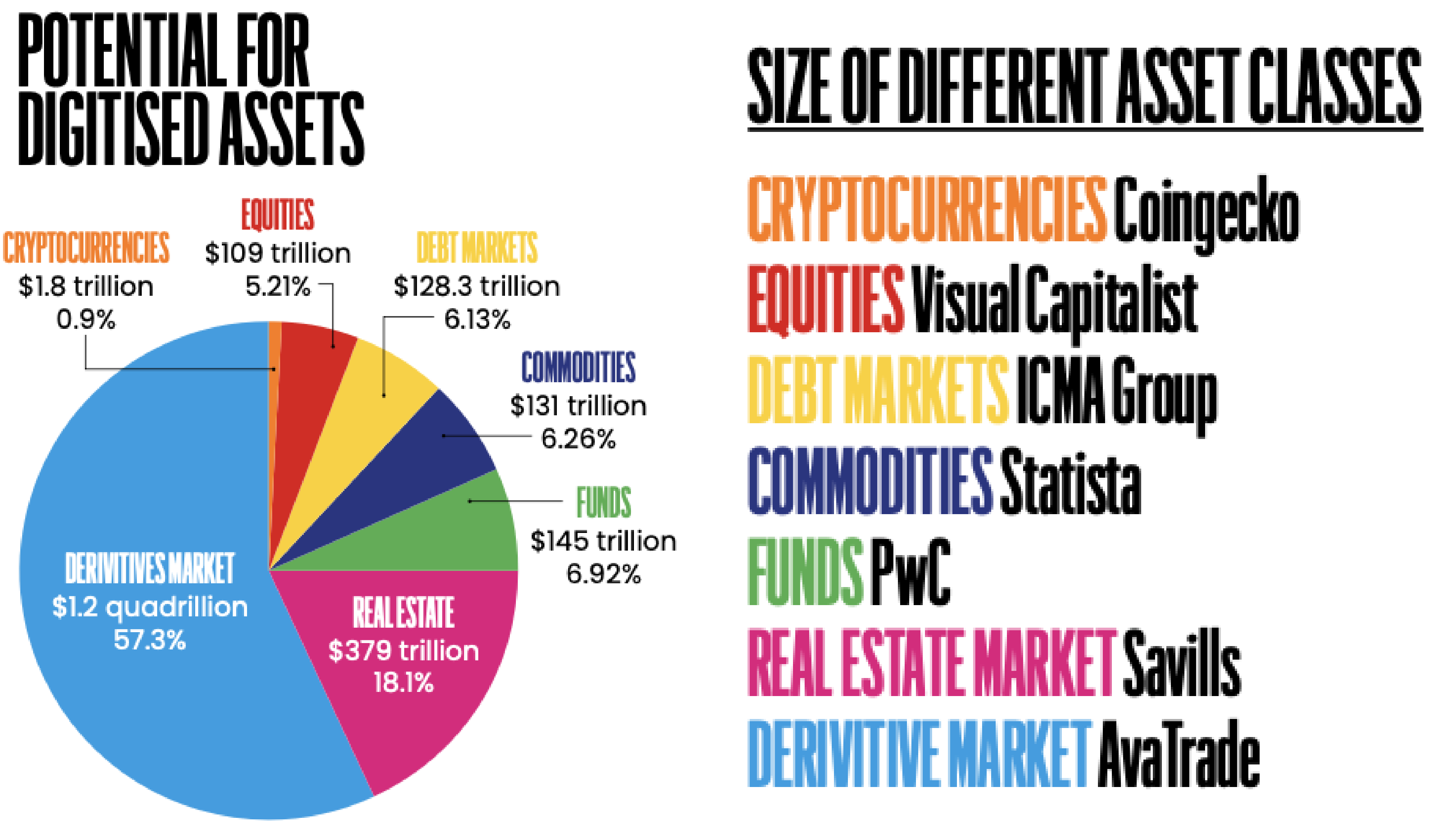

ClearBank is currently on a journey to building its international capabilities. In the meantime, we have been studying how we can future-proof the Bank and be prepared to offer our customers alternative payment solutions and services that work in the era of digital currencies, and which will be backed 100% by deposits held by a central bank. Such stablecoins could not be further from the world of cryptocurrencies. It is just worth noting that the entire capitalisation of all cryptocurrencies is still relatively small. As the chart below shows, bonds, equities, funds, commodities, real estate and derivatives combine to a total market in excess of $2 QUADRILLON. That is two with 24 zeros! What all these assets have in common is that the ecosystem needs a payment solution to buy and sell the assets, and in some cases, the same system needs to be able to distribute the income to the holders of these assets. Current practice is that income payments on most assets are made every six months. However, as we see the increasing tokenisation of assets, we will see investors being enabled to buy and sell 24/7 with a parallel distribution of income, maybe even on a daily basis.

Some examples of asset management firms which have started or are planning to digitise their funds include:

■ Privately bank-owned Metzler Asset Management, which has issued tokens for a single share class of its German-domiciled Sustainable Growth fund in a controlled distribution pilot, which took place on a public chain.

■ Germany has also legislated for digital securities to exist natively on-chain (without the need for a central securities depositary), and for funds to hold tokenised assets as well as funds to be tokenised at unit level.

■ Archax (a UK-regulated exchange has tokenised the abrdn money market fund.

■ In France, Generali’s fund range is now available digitally on a DLT platform, joining a large group of other fund firms’ listings for investors to select from.

■ In April 2023, the Franklin Templeton Money Market Fund was launched on the Polygon blockchain.

■ With $94billion under management, the US asset manager WisdomTree Prime offers nine digital funds using the Stellar or Ethereum blockchain.

■ Hamilton Lane’s $2.1 billion Direct Equity Fund on the Polygon blockchain means that, instead of being required to invest $5 million, you can gain access to this fund from as little as $20,000.

■ UBS launched a tokenised money market fund in Singapore.

■ Hong Kong is to allow tokenisation of securities and regulated funds.

■ Schroders has appointed Calastone.

■ Credit Agricole-owned Amundi, one of the top three European asset managers with $2.1 trillion assets under management, announced that it is to digitise its money market fund.

■ Matteo Andreetto, at State Street Global Advisors, has said: “The ability to fractionalise and digitise ETFs and private assets through tokenisation will be game-changing and something the firm will be looking at."

Another case for digital infrastructure is in the world of Foreign Exchange (FX). It is worth noting that the markets turnover in excess of $7.5 trillion per day, of which the UK has a 38% market share, with New York as its next nearest rival, with a share of 19%.

Historically, given that the UK had been a centre for trade and located between the Asian and US time zones, the UK had a unique advantage. However, as we begin to see digital currencies trading 24/7, the UK’s geographic advantage will be greatly diminished, as traders will be able to trade these assets from anywhere, thus challenging the UK’s current dominant position. To an extent this could be mitigated by a combination of the UK’s preeminent reputation as a financial services centre and being at the heart of innovation in digital payments. As the world becomes progressively more digitised, the need for digital payments will become more apparent.

ClearBank may be 250 years younger than its immediate predecessors, but payments, innovation and the cloud are in its DNA. There is no doubt that the next few years will see incredible innovation, especially in the area of digital currencies, with the result that payments and the broader banking and financial services sectors will become even more competitive and offer customers a range of alternatives for making payments that are even more efficient, speedy and transparent. Incumbents, regulators and policy-makers are having to run fast to keep up with innovation. Provided the new technologies that are deployed can increase trust and confidence in financial markets while offering better financial products and services, it becomes a win-win for us all.

Download your free copy of the latest Financial Technologist magazine here.